malaysia tax rate 2019

The birth rate is an issue of concern and policy for national governments. Employment by economic sector in Malaysia 2019.

Why Is Vietnam The First Choice Of Many Companies Instead Of India If They Are Planning To Move Manufacturing Units From China Quora

Must contain at least 4 different symbols.

. RPGT Exemptions tax relief Good news. The countrys obesity rate is 181 which is above the OECD average of 151 but considerably below the American rate of 277. Find IHGs best hotels worldwide using our hotels and destinations explorer.

There are no other local state or provincial. Also corporations can own shares in other corporations and receive corporate dividends 80 tax-free. ASCII characters only characters found on a standard US keyboard.

Insurance is a means of protection from financial loss. Monday through Saturdays 8am 5pm. Prices do not include sales tax.

The Personal Income Tax Rate in Sweden stands at 5290 percent. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for.

For example if income is taxed on a formula of 5 from 0 up to 50000 10 from 50000 to 100000 and 15 over 100000 a taxpayer with income of 175000 would pay a total. 632 8527-8121 All departments HOURS. After receiving the item contact seller within.

You can browse by location or by interest. South Africas unemployment rate was at 339 in the Q2 of 2022 down from 345 in the Q1 and a record high of 353 in the Q4 of 2021. No other taxes are imposed on income from petroleum operations.

Muralla cor Recoletos Sts. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity. This statistic shows the unemployment rate in Malaysia from 1999 to 2021.

In economics a local currency is a currency that can be spent in a particular geographical locality at participating organisations. 6 to 30 characters long. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions livestock and other goods. Paying Taxes a study from PwC and the World Bank Group was published annually from 2006 to 2019 using data from the World Bank Groups Doing Business StudyIn September 2021 the World Bank announced that it has discontinued Doing Business and therefore the Paying Taxes data on this page is not current and will only be retained for reference but will not be updated going.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550. Sales tax for an item 284997141581. If you owned the property for 12 years youll need to pay an RPGT of 5.

The list focuses on the main types of taxes. Youll pay the RPTG over the net chargeable gain. There are some exemptions allowed for RPGT.

Personal Income Tax Rate in Sweden averaged 5554 percent from 1995 until 2021 reaching an all time high of 6140 percent in 1996 and a record low of 3230 percent in 2020. In the United States corporations can sometimes be taxed at a lower rate than individuals. Netflix reports its UK earnings for the first time 14B in 2021 revenue and 317M in profit after moving UK-based subscribers to its British subsidiaries US streaming service behind The Crown and Stranger Things also pays record corporation tax of nearly 7m.

The tax rate on capital gains from securities held in such an account is 10 after a three-year holding period and 0 after the accounts maximum five years period is expired. Seller collects sales tax for items shipped to the following provinces. A regional currency is a form of local currency encompassing a larger geographical area while a community currency might be local or be used for exchange within an online communityA local currency acts as a complementary currency to a national.

This page provides - Sweden Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

The number of unemployed plunged 183 percent from a year earlier to 6120 thousand while employment increased 42 percent to 1602 million. In 2008 Greece had the highest rate of perceived good health in the OECD at 985. The effective rate is the total tax paid divided by the total amount the tax is paid on while the marginal rate is the rate paid on the next dollar of income earned.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The crisis started in Thailand known in Thailand as the Tom Yam Kung crisis. Meantime the labor force rose 31 percent to 1663.

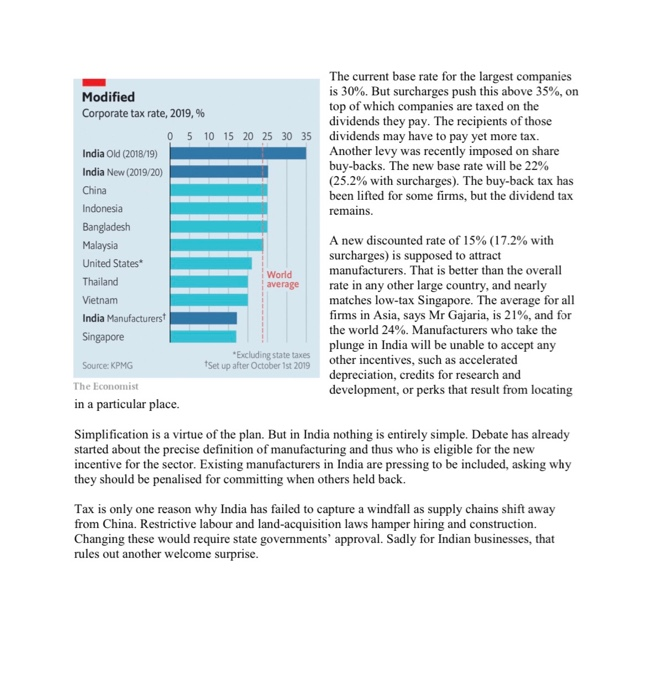

Some including those of Italy and Malaysia seek to increase the birth rate with financial incentives or provision of support services to new mothersConversely other countries have policies to reduce the birth rate for example Chinas one-child policy which was in effect from 1978 to 2015. And your tax rate and amount decided you can claim for. Infant mortality is one of the lowest in the developed world with a rate of 31 deaths1000 live births.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagionHowever the recovery in 19981999 was rapid and worries of a meltdown subsided.

Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not. Among sectors job gains were mainly. The number of unemployed persons increased by 132 thousand to 7994 million employment rose by 648 thousand to 15562 million and the labour force went up by 780 thousand to 23556 million.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Unemployment rate in Malaysia 2021. Intramuros Manila 1002 PO.

The gross amount of interest royalty and special income paid by the payer to a NR payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is a tax resident. Province Sales Tax Rate Tax applies to subtotal shipping handling for these states only. 3 days after the buyer receives it.

In mid-April 2019 the Coalition. The unemployment rate in Malaysia declined to 37 percent in August 2022 from 46 percent in the same month a year earlier as the economy recovered from the coronavirus hit. In different parts of the world a marketplace may be described as a souk from the Arabic bazaar from the Persian a fixed mercado or itinerant tianguis or palengke PhilippinesSome markets operate daily and are said to be.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Alton Tax Rate Drops Nearly 11 Percent Local News Laconiadailysun Com

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Based On This Article Can Someone Help Me Identify Chegg Com

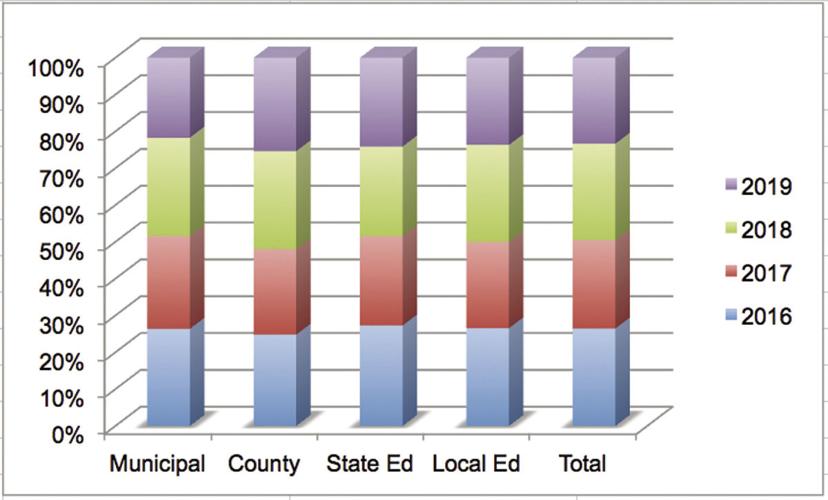

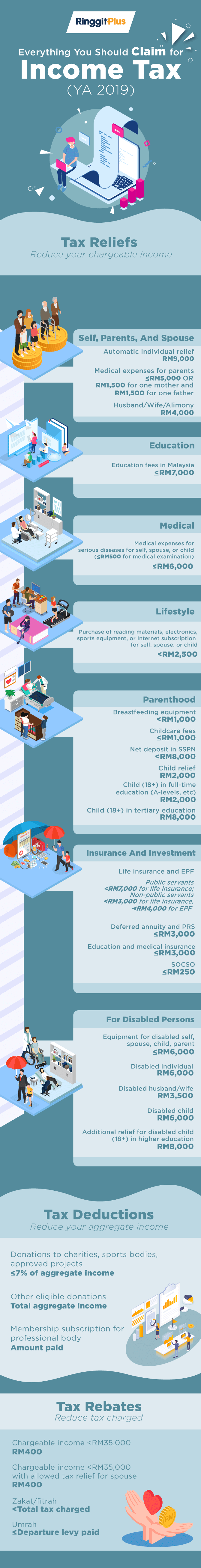

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Peru Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical Chart

Corporate Tax Rates Around The World Tax Foundation

Solved The Ministry Of Finance Mof Has Also Indicated Chegg Com

Colombia Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

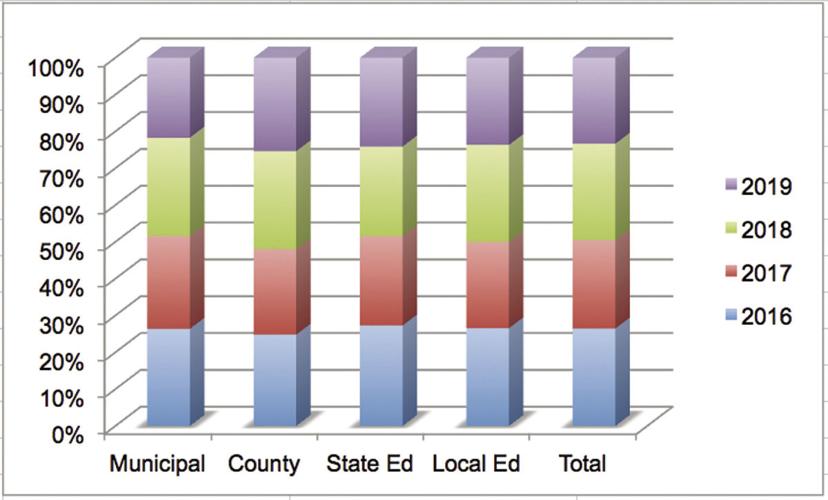

Big Bang Reforms In India To Revive The Economy

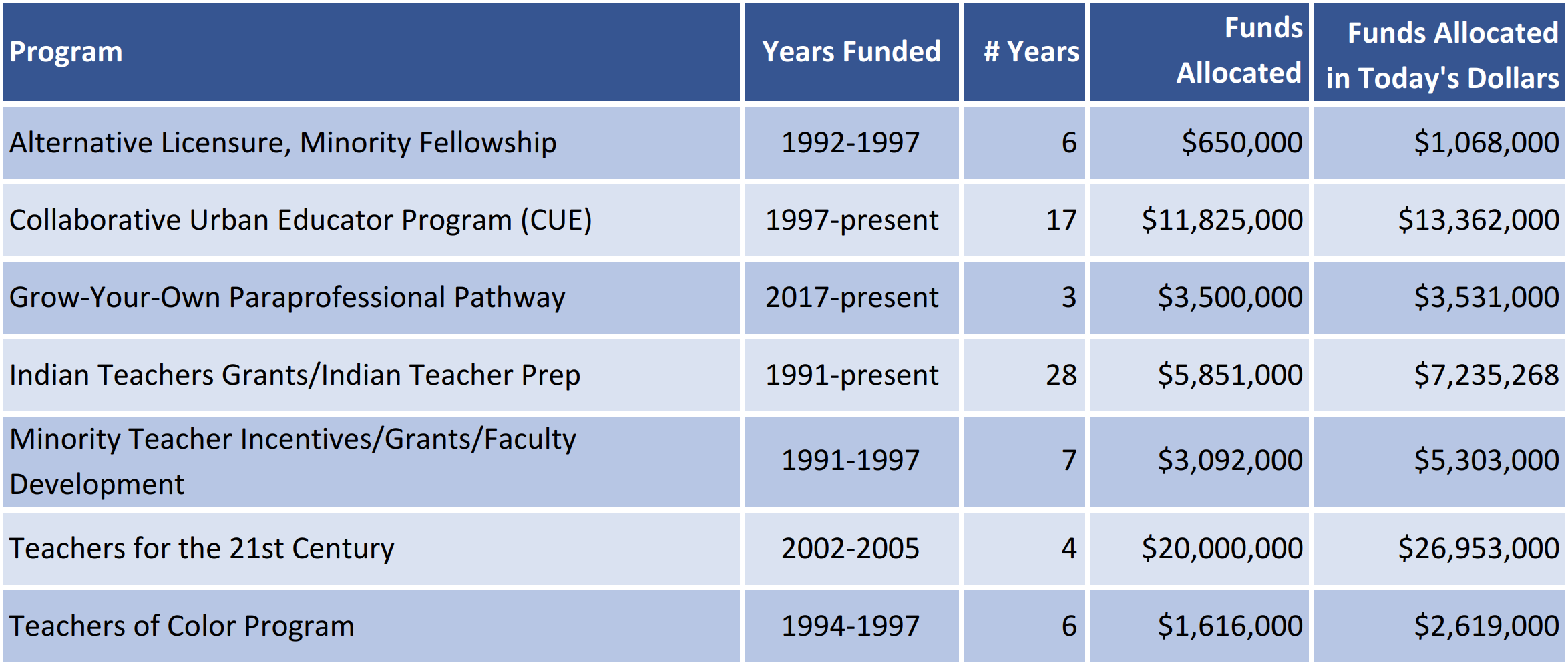

Why Do Teachers Of Color Leave At Higher Rates Than White Teachers Education Evolving

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

2020 E Commerce Payments Trends Report Malaysia Country Insights

Global Forest Loss Increased In 2020

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Comments

Post a Comment